Whether you are turning 65 about to reach retirement and brand new to medicare, or you been on medicare for years and want to compare your current coverage, and possibly switch your plan, or you have delayed your medicare and your retirement benefits are ending and you need medical coverage, LifeandMed is here for you. Our agents will guide you through your individual situation and help you identify your options for your budget and medical needs.

Medicare Part A, Part B, Part C, and Part D Explained : What does Medicare Cover?

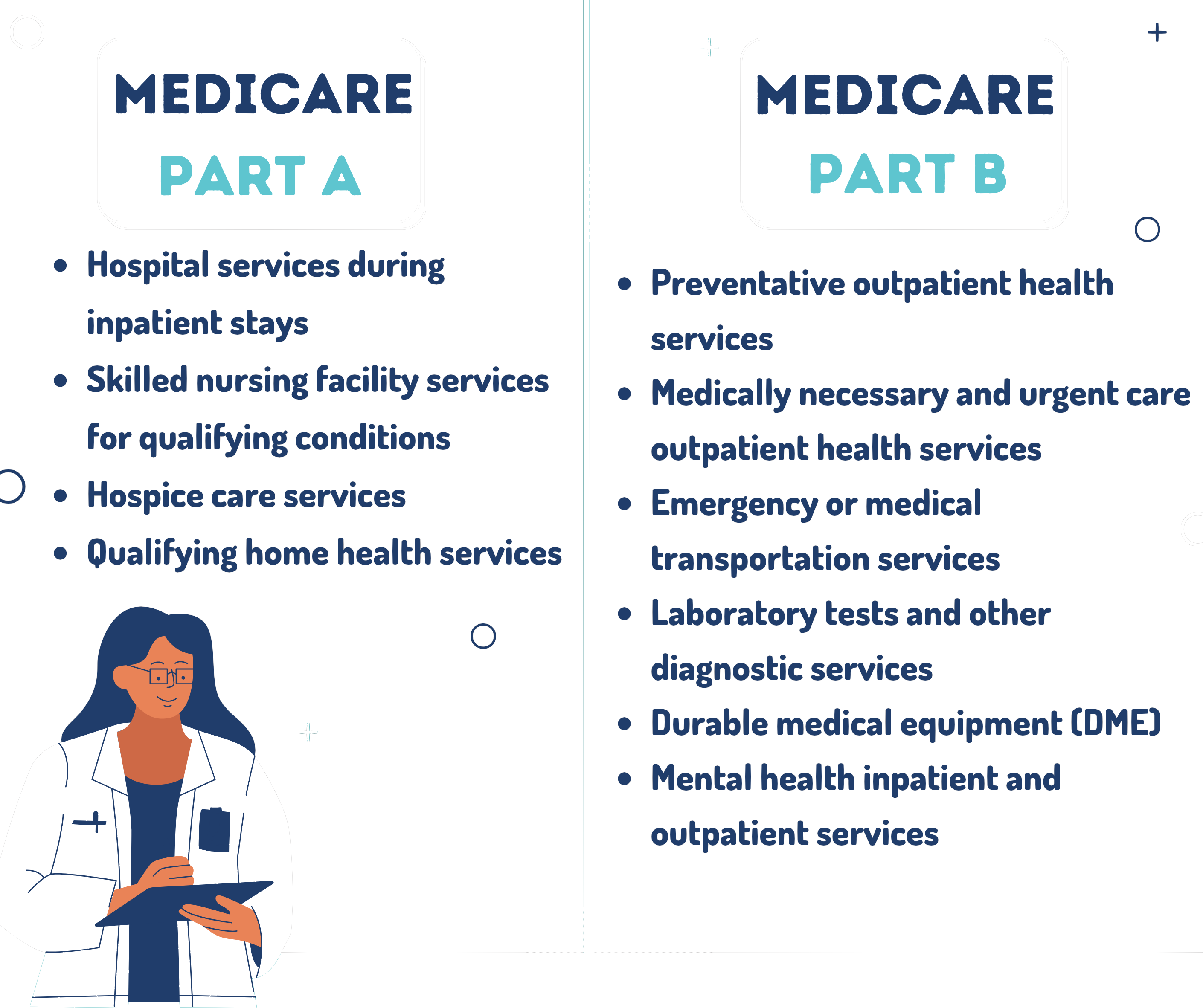

What Original Medicare Covers?

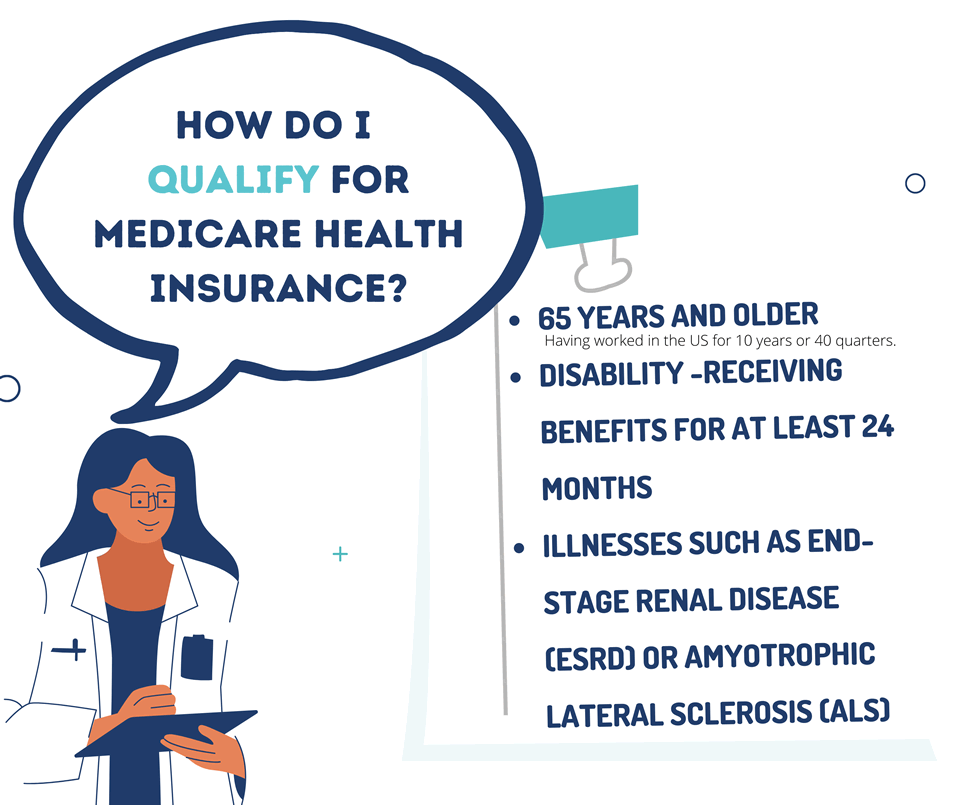

How Do I Qualify For Medicare?

People qualify for Medicare health insurance in one of three ways:

If you already receive Social Security or Railroad Retirement Board (RRB) benefits when you gain eligibility for Medicare health insurance, Uncle Sam may automatically enroll you. Otherwise, you’ll likely use your Initial Enrollment Period (IEP), a seven-month window that begins three months before you become eligible for coverage.

How to Apply for Medicare?

People can apply for Medicare in one of three ways:

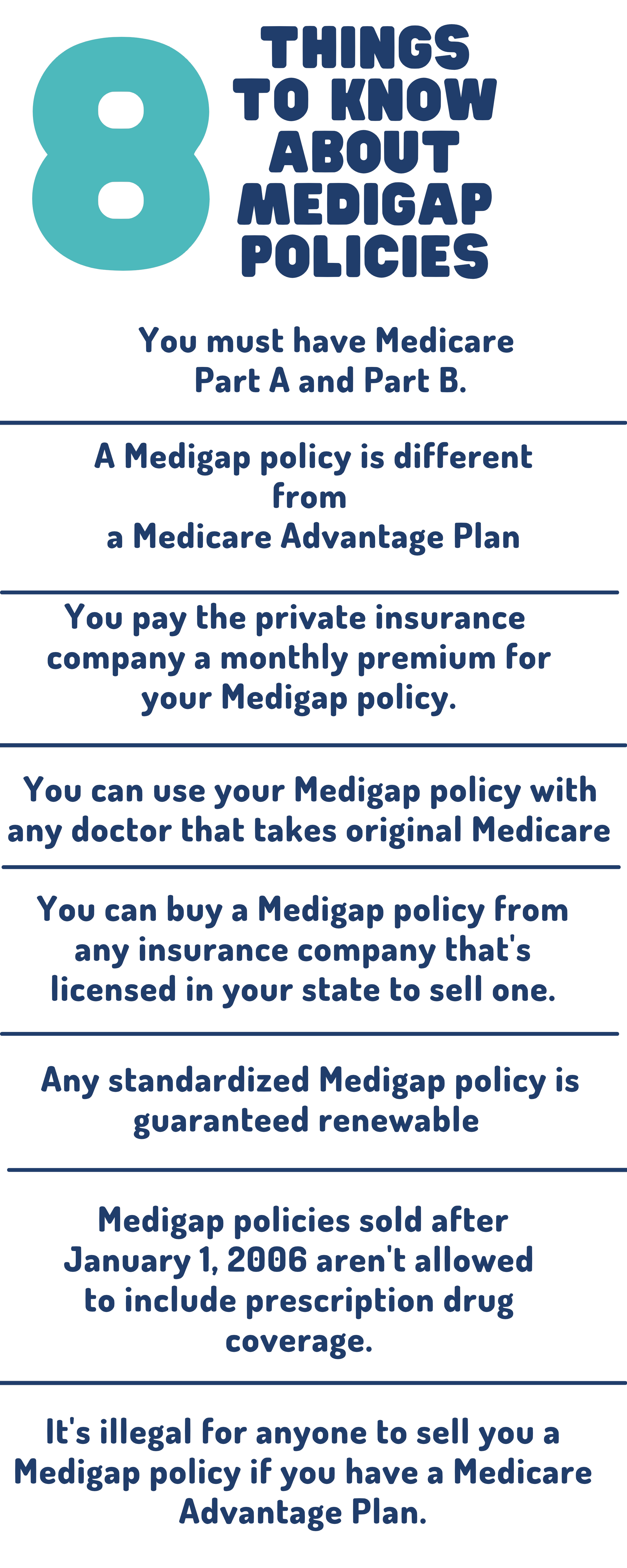

Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020. If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans that cover the Part B deductible.

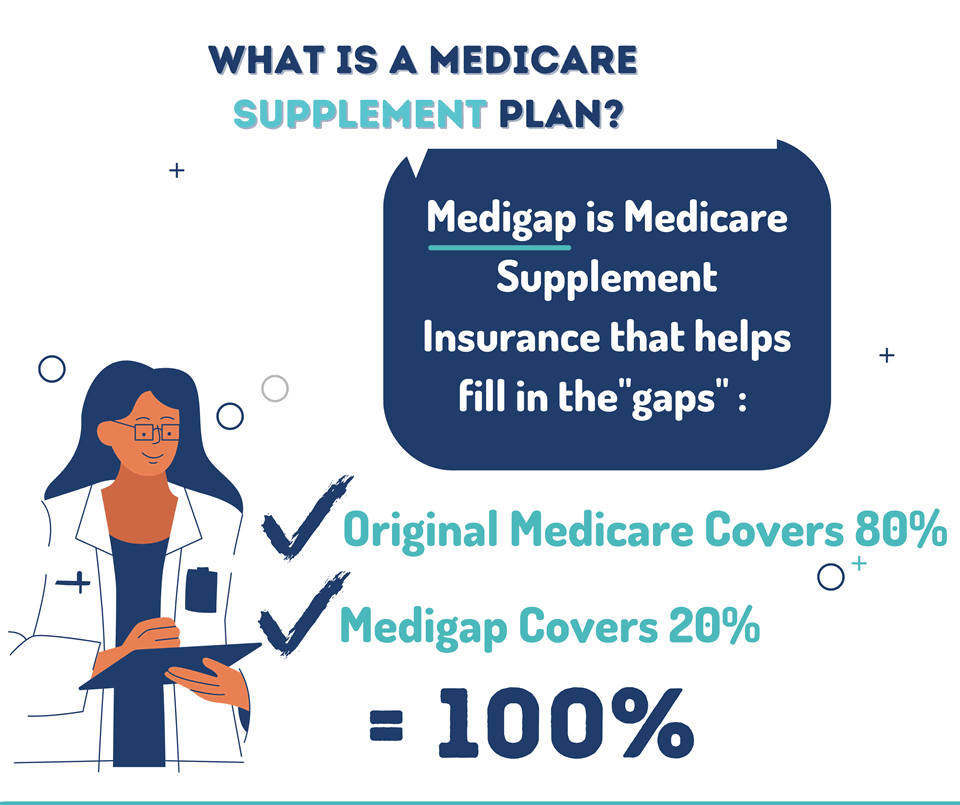

Some Medigap policies also cover services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, here’s what happens:

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have Medicare. These “bundled” plans include Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance), and usually Medicare drug coverage (Part D).

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness.

What you pay in a Medicare Advantage Plan depends on several factors. In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. Some plans won’t cover services from providers outside the plan’s network and service area

Who can buy a Medigap policy?

- Your prescriptions and whether they’re on your plan’s list of covered drugs (formulary).

- What “tier” the drug is in.

- Which drug benefit phase you’re in (like whether you’ve met your deductible, or if you’re in the catastrophic coverage phase).

- Which pharmacy you use (whether it offers preferred or standard cost sharing, is out of network , or is mail order). Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less.

- Whether you get Extra Help paying your drug coverage

What if I don’t apply for Medicare? What are my options?

- The size of the employer determines whether you may be able to delay Part A and Part B without having to pay a penalty if you enroll later.

The employer has less than 20 employees

- You should sign up for Part A and Part B when you’re first eligible. In this case, Medicare pays before your other coverage. Learn more about how to get Parts A and B.

The employer has 20 or more employees

- Ask your benefits manager whether you have group health plan coverage (as defined by the IRS). People with group health coverage based on current employment may be able to delay Part A and Part B and won’t have to pay a lifetime late enrollment penalty if they enroll later. If you want to delay both Part A and Part B coverage, you don’t need to do anything when you turn 65.

Will I be penalized for not having Medicare?

If you didn’t get Part B when you’re first eligible, your monthly premium may go up 10% for each 12-month period you could’ve had Part B, but didn’t sign up. In most cases, you’ll have to pay this penalty each time you pay your premiums, for as long as you have Part B. And, the penalty increases the longer you go without Part B coverage.

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period.

If you have limited income and resources, your state may help you pay for Part A, and/or Part B. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage.

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium.

You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage. You’ll generally have to pay the penalty for as long as you have Medicare drug coverage.

If you get extra help, you don’t pay the late enrollment penalty.

Call Us

LifeandMed to shop over the top insurance carriers to compare rates and pick the best option. We do all the work. If we determine you are already in the best plan, we will relay that to you as well we will not switch you over

DELAYED YOUR MEDICARE

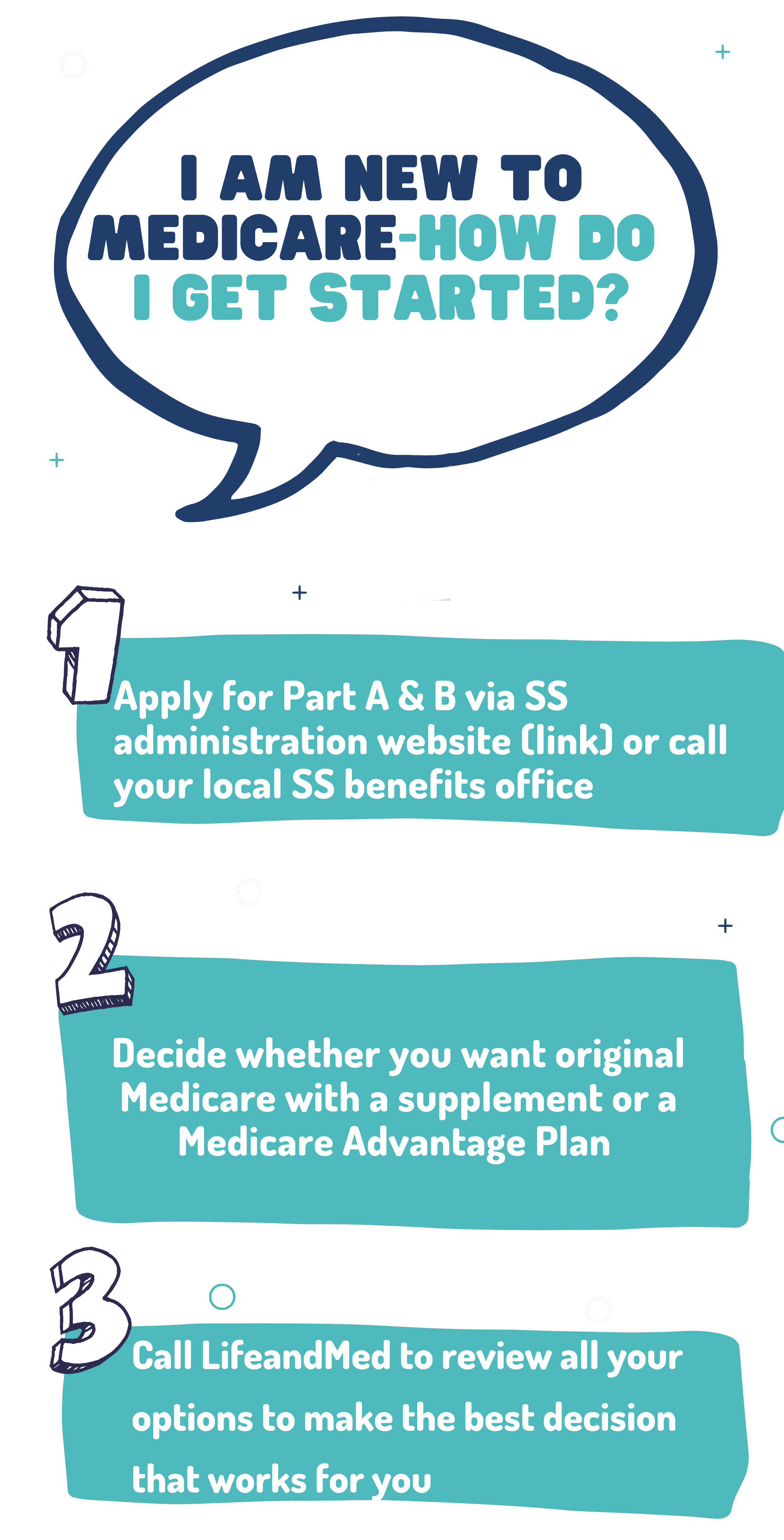

Step 1 – Apply for Part A & B via SS administration website or call your local SS benefits office.

Step 2 – Complete the following forms: CMS-40B and CMS-L564 – with your previous employer to indicate you had credible medical coverage to exhibit the delay medicare.

You can also fax the CMS-40B and CMS-L564 forms to 1-833-914-2016; or return forms by mail to your local Social Security office. Please contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778) if you have any questions.

- If your employer is unable to complete Section B, please complete that portion as best you can on behalf of your employer without your employer’s signature.

- Submit one of the following types of secondary evidence by uploading it from a saved document on your computer:

-

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

Step 3 – Call Life and Med to help pick the Medicare plan that works for you

MEDICARE & YOU HANDBOOK

(Medicare & You in English, print [PDF, 3132 KB])